Example:

If you stake 1,000 tokens with an APR of 12%, then in one year you will earn an additional 120 tokens — a total of 1,120 tokens, assuming the interest is not compounded.

APR Definition in the World of Finance and Cryptocurrency

Literally, APR is the “annual percentage rate” — a standard measure for assessing the annual interest on a loan or investment.

However, APR’s function depends on context:

1. In traditional finance

APR describes the annual cost of a loan, including interest and administrative fees.

Examples:

- A credit card with an APR of 18% means that 18% annual interest is charged on the total balance if it is not paid in full.

- A car loan with an APR of 10% means that the annual loan cost is 10% of the total principal.

2. In crypto and DeFi

APR serves as an indicator of the estimated annual return that can be obtained from:

- Token staking (such as on DRX Token or Ethereum 2.0),

- Yield farming (such as on PancakeSwap, Aave, or Uniswap),

- Crypto lending (such as on Compound).

APR helps investors compare returns from different platforms without having to calculate compound interest—making it a simple and straightforward metric.

The APR Formula and How to Calculate It

The general formula for APR is simple:

APR = (Yearly interest / Principal Amount) x 100%

In practice, APR may vary depending on additional costs.

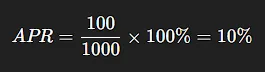

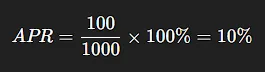

🔸 General example:

You invest 1.000 USDT in a staking platform with 10% annual interest rates.

Then:

So, after one year, you will earn an additional 100 USDT, making you own a total of 1.100 USDT.

🔸 Example in DeFi:

Say a liquidity pool on PancakeSwap offers an APR of 40%.

If you deposit liquidity worth 500 USDT, your estimated annual return is:

500×40%=200 USDT

However, this does not include compound interest and does not take into account token price fluctuations (impermanent loss).

APR in Crypto and DeFi

APR is widely used in the DeFi (Decentralized Finance) ecosystem to indicate the potential return on investment from activities such as:

1. Token Staking

Staking platforms such as DRX, Ethereum, or Solana offer a certain APR to users who lock their tokens to help keep the network secure.

- For example, staking DRX Tokens offers an APR of 15%.

- If you stake 1,000 DRX for one year, you will earn an additional 150 tokens.

2. Yield Farming

Here, APR indicates the annual return earned from providing liquidity on DEXs such as PancakeSwap, Uniswap, or SushiSwap.

However, the APR can change depending on:

- Transaction volume.

- Total Value Locked / TVL.

- Distributed reward tokens.

3. Lending & Borrowing

On platforms such as Aave, Compound, or Venus, APR is also used to indicate loan interest rates and lender returns.

- Borrow APR → interest paid by borrowers.

- Supply APR → interest received by lenders.

APR vs APY: Which is More Profitable?

Despite its similarities, APR and APY have significant differences in compounding interest.

| Short For | Annual Percentage Rate | Annual Percentage Yield |

| Component | Does not include compound interest | Includes compound interest |

| Suitable for | Fixed returns/loans | Staking or yield farming with auto-compounding |

| Formula | Annual interest ÷ Principal | (1 + r/n)^n - 1 |

| Final returns | Lower | Higher (due to compounding) |

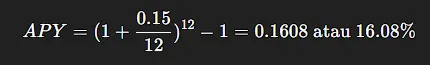

🔸 Example:

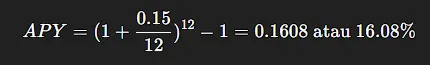

If APR = 15% and interest is compounded monthly (12 times a year):

Meaning, even though APR is only 15%, APY provides effective returns of 16,08% due to compounding interest.

Hence, a lot of DeFi platforms prefer displaying APY over APR for a more realistic projection.

Read Next

What is APY: How it Works, Formula, and Examples in DeFi

Liquidity Pool Is: Definition and How it Works in DeFi

Volatility Is: Why the Crypto Market Fluctuates So Much

How to Stake DRX Token for Beginners

Seeing high APR figures on dApps such as PancakeSwap, Aave, or Uniswap is tempting, but it's important to understand the context:

1. Don’t just look at numbers

A high APR does not necessarily mean it's profitable. Sometimes new platforms raise APR to attract liquidity (such as 200–500%) — but it can drop dramatically when other users join in.

2. Pay attention to reward types

Is the reward paid in stable tokens (such as USDT/USDC) or the project's own tokens (such as CAKE, DRX, or UNI)?

Reward tokens with fluctuating values can affect the final outcome.

3. Check compounding mechanism

If the platform doesn't have an auto-compounding feature, your returns are calculated based on pure APR, not APY.

However, you can increase your returns with manual reinvestment — claiming rewards and adding them back to the pool.

Pros and Cons of APR

Pros

- Easy to understand: Only calculates annual interest without additional components.

- Transparent: Suitable for fixed loans or staking.

- Common standard: Widely used in the financial sector and DeFi.

Cons

- Does not account for compound interest: Actual returns may be higher (if compounding is involved).

- Less accurate for automated staking: APY provides a more realistic picture.

- Can be misleading if token rewards fluctuate.

Case Study: Calculating APR and APY for DRX Token Staking

Here is a simple illustration for better understanding:

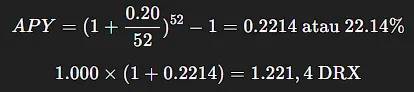

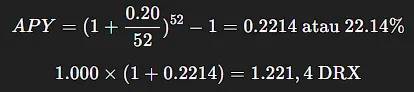

- You stake 1,000 DRX Tokens with an APR of 20%

- The platform performs weekly compounding (52 times a year)

Without Compounding (APR)

1.000×20%=1.200 DRX after 1 year

With weekly compounding (APY)

A difference of 21 tokens (1.221 – 1.200) is the effect of weekly compounding interest..

Conclusion: APR is A Crucial Foundation Before Investing

APR is the main compass that helps investors and DeFi users understand estimated returns or borrowing costs.

However, APR is not a fixed number — actual results may vary depending on the presence of compound interest (APY), price volatility, or reward distribution mechanisms.

Before investing on a DeFi platform, ensure you:

- Read the project documentation,

- Understand the difference between APR and APY,

- And calculate realistic potential returns based on market risk.

In the crypto world, large numbers often attract attention, but thorough understanding is what protects your assets.