- Token staking

- Yield farming on DEXs

- Crypto lending

So, when you see a platform promising “20% APY,” it means that if you deposit your funds there for a full year, and the interest is compounded at a certain frequency, the potential return is equivalent to 20% per year.

How APY Works in Cryptocurrency

Compound Interest

The essence of APY is compounding—the effect of interest generating new interest.

Say you have 1,000 USDT with an APY of 10% per year. If the interest is compounded daily, the final result will be slightly more than 1,100 USDT because the interest earned each day adds to the capital.

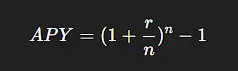

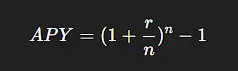

The basic APY formula is:

With:

- APR = annual interest rate (in decimals, e.g., 15% = 0,15)

- Compound Frequency = how many times the interest is calculated per year

- Yearly = 1

- Monthly = 12

- Daily = 365

The higher the compound frequency, the bigger the results.

| 10% | Yearly | 10% |

| 10% | Monthly | 10,47% |

| 10% | Daily | 10,52% |

This means that two DeFi projects with 10% APR can yield different results if they have different compounding frequencies.

APY vs APR — What’s the Difference?

The term APR (Annual Percentage Rate) is often confused with APY, but the two are not the same.

APR: Measures annual interest without taking compound interest into account.

APY: Measures annual interest by taking compound interest into account.

Example:

If a platform offers 10% APR, then for one year, you will receive a fixed interest rate of 10%.

However, if it offers 10% APY with daily compounding, the result will be slightly higher than 10%, as shown in the previous table.

Conclusion:

APY is always higher than APR if compounding is involved. This is why DeFi tends to use the term APY—it looks more profitable.

Example of APY Crypto Calculation

Let us look at a concrete example. Say you stake DRX Token with a value of 1.000 tokens and an APY of 15%. The platform performs weekly compounding (52 times a year).

Then:

This means that, with a capital of 1,000 tokens, in one year, you will earn a total of around 1,284 DRX Tokens — not 1,250 as in APR. The difference of 34 tokens comes from the effect of interest compounded weekly.

Where is APY Used in Cryptocurrency?

1. Token Staking

Staking is the activity of locking tokens in a blockchain network to help maintain security and validate transactions. In return, users receive rewards in the form of new tokens.

Example:

- Ethereum 2.0 Staking: around 3–5% APY

- Cardano (ADA): around 4–6% APY

- DRX Token Staking: up to 36% depending on APY and pool

2. Yield Farming

In yield farming, users provide liquidity to the liquidity pool (such as on PancakeSwap, Uniswap, or DRXSwap). In return, they receive a part of the transaction fee and additional token rewards.

Stablecoin pool (USDT/USDC): 5–10% APY

Altcoin pair (ETH/DRX): 20–50% APY

High-risk pool: up to hundreds of percent, but the risk of impermanent loss is also high.

3. Lending & Borrowing

Platforms like Aave, Compound, or DRX Lending enable users to lend crypto assets in exchange for APY. The value of APY depends on demand and market interest rates.

Risks Behind High APY

“High APY = high profits” sounds appealing, but it's not always true.

Here are some risks to be aware of:

1. Token Price Fluctuations

A high APY does not guarantee profit in dollars if the token price drops dramatically.

For example, if you earn a 100% APY on a token whose value plummets by 80%, the net result could still be a loss.

2. Token Reward Inflation

Some DeFi projects issue new tokens as rewards to maintain high APY, but this can create inflation and depress token prices over the long term.

3. Rug Pulls and Smart Contract Bugs

Platforms with extreme APY (500% or higher) are likely not properly audited. The risk of a rug pull — developers withdrawing all funds — is very high. Ensure the project has a smart contract audit from a trusted institution.

4. Impermanent Loss

Especially in liquidity pools, price changes between token pairs can cause temporary losses (impermanent loss). Even with a high APY, the result can be negative if volatility is high.

How to Calculate APY Manually and Automatically

Manual APY Formula

Example:

Calculation order

- 0,15 ÷ 12 = 0,0125

- (1 + 0,0125) = 1,0125

- (1,0125)¹² = 1,1608

- 1,1608 - 1 = 0,1608 → 16,08%

Online Tools

You don’t always have to calculate APY manually..

Some popular tools to calculate APY in cryptocurrency:

- StakingRewards.com

- DeFiLlama

- APY Vision

With these tools, you can see and compare different projects’ APYs in real-time, along with their risks and TVL (Total Value Locked) data.

Also Read

What is a Crypto Market Cap: How to Read the Size of a Digital Market

Volatility Is: Measuring Risks and Opportunities in Cryptocurrency

What is a Liquidity Pool and How Does It Work in DeFi?

Strategies to Maximize APY Safely

Chasing the highest APY possible is valid, as long as you perform strict risk management. Here are some practical tips from professional DeFi analysts:

1. Diversify Platforms

Don't put all your funds in one project, especially if it hasn't been audited. Minimize the risk by spreading funds across several reputable platforms.

2. Use Validated Platform

Choose protocols that have undergone security audits (e.g., CertiK, SlowMist, or PeckShield). Audits don’t 100% guarantee security, but they reduce the risk of bugs and scams.

3. Pay Attention to Transaction Fees

On networks like Ethereum, gas fees can cut into your APY returns. Alternatives such as Binance Smart Chain (BSC) or DRX Chain are more efficient.

4. Use Auto-Compounding Strategies

Some protocols (e.g., Beefy Finance, DRX Vaults) offer auto-compounding features to maximize returns without having to reinvest manually.

5. Evaluate APY vs Risks

Don't get blindsided by offers of 1000% APY without understanding the tokenomics model. In the world of DeFi, high APY often means high risk.

Real APY Examples in Cryptocurrency

| Platform | Product Type | APY Estimate | Risk Level |

| Ethereum Staking | Proof-of-Stake | 4–6% | Low |

| Aave | USDC Lending | 3–5% | Low |

| PancakeSwap | CAKE-BNB Yield Farming | 20–40% | Moderate |

| High-risk DeFi | New tokens | 500%+ | High |

The table shows that higher APY means higher risks.

Experienced investors find a balance between stable returns and asset security.

In addition to measuring potential returns, APY is also used as an indicator of a DeFi project’s efficiency and attractiveness.

Projects with stable APY indicate a healthy ecosystem and real demand. Conversely, a drastic spike in APY could signal an imbalance in incentives or token reward manipulation

Some analysts even compare APY data across platforms to measure capital flow in DeFi — similar to how stock analysts monitor bond yield curves.

Conclusion: APY is a Reflection of Opportunities and Risks

APY (Annual Percentage Yield) is not just a pretty number on your staking dashboard. It is a metric that reflects the potential growth of your capital in a year, taking compound interest into account.

However, a high APY is not a guarantee of big profits. In the highly dynamic world of crypto, smart investors understand that high returns always come with high risks.

Use APY as an analytical tool, not as the sole reason for investing.

Just like other fundamental investment principles, understand the risks first before pursuin profits.

FAQ (Frequently Asked Questions)

What is the difference between APR and APY?

APR does not take into account compounding interests, while APY does.

Why can APY change over time?

APY is affected by the amount of funds in the pool, transaction volume, and circulating token rewards.

Is high APY always a good thing?

Not necessarily. A high APY can indicate high risk or huge token inflation.

How to calculate APY in cryptocurrency?

Use the formula: (1 + r/n)^n - 1 or tools such as DeFiLlama and StakingRewards.

Where can I find the best APY?

On reputable DeFi platforms such as Aave, DRXSwap, PancakeSwap, or official staking in large blockchains.