Crypto Arbitrage - The crypto market is known for its rapid price fluctuations and differences in value between exchanges. These conditions create opportunities for traders to profit without having to wait for long-term price trends. One strategy that is widely used is crypto arbitrage.

What is Crypto Arbitrage

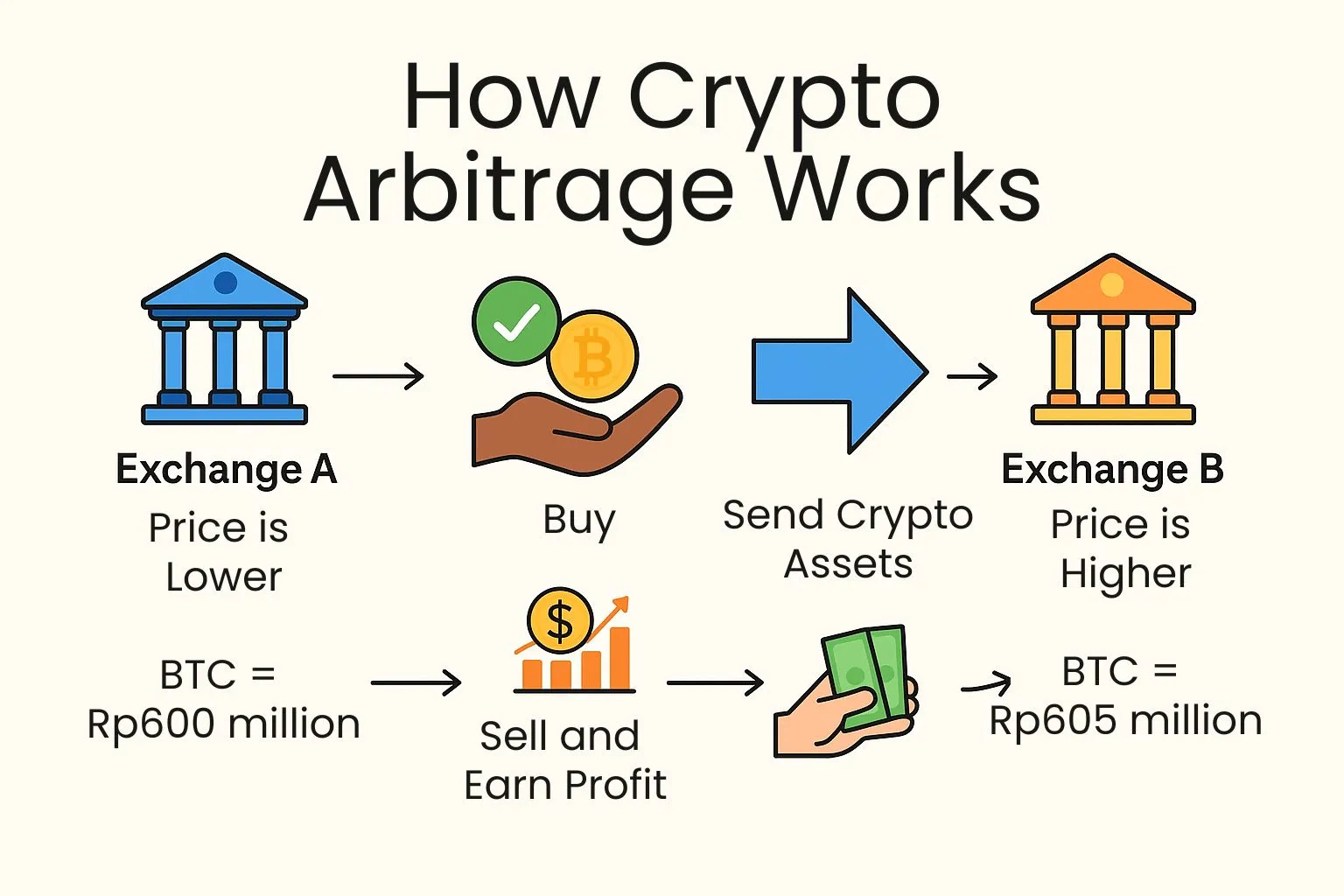

Crypto arbitrage is the practice of buying digital assets on one exchange at a low price and then selling them on another exchange that offers a higher price. This price difference is the source of profit.

Example: Bitcoin is priced at Rp500 million on Exchange A, while on Exchange B it is traded at Rp505 million. If a trader buys on A and sells on B, there is a potential profit of Rp5 million before fees are deducted.

Unlike regular trading, which depends on price increases and decreases, arbitrage focuses on price differences between markets.

Types of Arbitrage

| Types of Arbitrage | Characteristic | Difficulty Level |

| Cross-Exchange | Buy on one exchange at a lower price, sell on another exchange | Low |

| Triangular | Utilize the value difference between trading pairs in one exchange | Moderate |

| Statistics | Utilizes algorithms and mathematical models | High |

| On-chain vs Off-chain | On-chain on DeFi, Off-chain on CEX | Varies |

How Does Crypto Arbitrage Work?

The simplified steps of a crypto arbitrage are:

- Find a price difference.

- Purchase on the exchange where price is lower.

- Transfer or sell the asset on the exchange where price is higher.

- Earn net profit after transaction fees are deducted.

Baca Juga

Pros and Cons of Crypto Arbitrage

Pros

- Potential for quick profits.

- The market is active 24/7.

- Serves as an additional strategy to regular trading.

Cons

- Narrow profit margin, especially when fees are high.

- Competition against bot trading.

- Requires large capital.

Risks of Crypto Arbitrage

- Transaction and withdrawal fees can reduce profits.

- Slow transfer times can lead to missed opportunities.

- Low liquidity on small exchanges makes execution difficult.

- Different regulations across countries.

Strategies for An Effective Crypto Arbitrage Trading

- Keep funds in multiple exchanges for fast execution.

- Choose exchanges with high volume and liquidity.

- Use arbitrage bots for faster execution.

- Focus on popular assets like BTC, ETH, or USDT.

- Regularly check monitoring tools such as CoinMarketCap or ArbiTool.

Crypto Arbitrage Case Study

| Exchange | ETH Price | Action |

| Exchange A | Rp35.000.000 | Buy 2 ETH |

| Exchange B | Rp35.300.000 | Sell 2 ETH |

- Capital: Rp70.000.000

- Selling price: Rp70.600.000

- Gross profit: Rp600.000

- Net profit (after transaction fees): ±Rp400.000

This simulation demonstrates that arbitrage is profitable, but requires large capital to earn considerable profit.

Is Crypto Arbitrage Suitable for Beginners

- Can serve as an initial exposure to price dynamics between exchanges.

- Not ideal for traders with small capital because the costs can be greater than the profits.

- More effective when used in conjunction with bot trading.

Conclusion

Crypto arbitrage is a strategy to earn profit from the price differences of digital assets across different exchanges. This strategy can generate quick profits, but it is not risk-free. Capital, execution speed, and cost calculations are important factors in determining success.

If you are just starting out, try practicing with popular assets with high volume, while still paying attention to transaction costs.

FAQ About Crypto Arbitrage

1. What is crypto arbitrage?

A strategy of buying crypto on one exchange at a low price and selling it on another exchange at a higher price.

2. Is crypto arbitrage trading safe?

It is relatively safe when conducted on reputable exchanges, but there are still risks related to costs and transaction speed.

3. Is crypto arbitrage trading beginner-friendly?

It's suitable as a learning tool, but profits can be slim if your capital is small.

4. What is the minimum capital?

Ideally, Rp10–20 million so that the profit margin is noticeable after deducting costs.

5. What is the difference between crypto arbitrage and regular trading?

Arbitrage focuses on price differences between exchanges, while regular trading focuses on price changes on a single exchange.

70+ Crypto Terms and Definitions for Beginners | DRX Token Dictionary

Published Date:12 Feb 2026• Read Time:5 minutes

Real-World Asset Tokenization: The Future of Digital Investments

Published Date:23 Jan 2026• Read Time:7 minutes

What is Layer 1 Blockchain? Full Explanation and Examples

Published Date:22 Jan 2026• Read Time:5 minutes

Crypto Bull Run 2026 Predictions: Indicators, Trends, and Profit Potential

Published Date:21 Jan 2026• Read Time:7 minutes

10 Ways to Make Money on Web3: From Airdrops to Creator Economy

Published Date:20 Jan 2026• Read Time:7 minutes